jacksonville fl sales tax rate 2019

History of Florida Sales and Use Tax 3 - November 1 1949 to March 31 1968. The current total local sales tax rate in Jacksonville Beach FL is 7500.

Alabama Tax Rates Rankings Alabama Taxes Tax Foundation

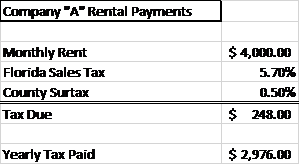

The Florida Department of Revenue FDOR has released its 2019 tax rates for general sales tax and commercial rent sales tax.

. The tax rate was approved in advance of councils review of Currys proposed 13. The 32277 Jacksonville Florida general sales tax rate is 75. Floridas general state sales tax rate is 6 with the following exceptions.

This is the total of state county and city sales tax rates. The average cumulative sales tax rate in Jacksonville Florida is 75. History of Local Sales Tax and Current Rates Last Updated.

History of Florida Sales and Use Tax 3 -. The December 2020 total local sales tax rate was 7000. The minimum combined 2022 sales tax rate for Jacksonville Florida is.

The minimum combined 2022 sales tax rate for Jacksonville Beach Florida is. June 1 2022. The 75 sales tax rate in Jacksonville Beach consists of 6 Florida state sales tax and 15 Duval County sales tax.

The new year also brings new sales tax rates. Groceries are exempt from the Duval County and Florida state sales. Jacksonvilles property tax rates likely will remain unchanged in the 2019-20 fiscal year.

Average Sales Tax With Local. Groceries and prescription drugs are exempt from the Florida sales tax. This is the total of state county and city sales tax rates.

Jacksonville has parts of it located within Duval. The 825 sales tax rate in Jacksonville consists of 625 Texas state sales tax 05 Cherokee County sales tax and. The Florida Department of Revenue FDOR has released its 2019 tax rates for general sales tax and commercial rent sales tax.

The 8 sales tax rate in Jacksonville consists of 625 Illinois state sales tax 1 Morgan County sales tax and 075 Jacksonville tax. 127 rows Four citiesTampa Florida and Bakersfield Chula Vista and Riverside Californiasaw sales tax rate increases of 1 percent or more in the first half of. An alternative sales tax rate of 75 applies in the tax region.

Specifically Florida levies a sales tax at the rate of. Florida has state sales tax of 6 and allows local governments to collect a local option sales tax of up to 15. The new year also brings new sales tax rates.

The December 2020 total local sales tax rate was 7000. Jacksonville collects the maximum legal local sales tax. 5 April 1 2009 1.

The Florida sales tax rate is currently. Prior to 112019 112019 - 12312021 On or after 112022. What is the sales tax rate in Jacksonville Florida.

The current total local sales tax rate in Jacksonville FL is 7500. This includes the rates on the state county city and special levels. There is no applicable special tax.

The December 2020 total local sales tax rate was 7000. There is no applicable special tax. Retail sales of new mobile.

4 rows The current total local sales tax rate in Jacksonville FL is 7500. The Florida state sales tax rate is 6 and the average FL sales tax after local surtaxes is 665. The Jacksonville Beach Florida sales tax rate of 75 applies to the following two zip codes.

Florida State Taxes 2021 2022 Income And Sales Tax Rates Bankrate

How To Calculate Florida Sales Tax On A Car Squeeze

What Is Florida Sales Tax On Cars

2021 Florida Sales Tax Rates For Commercial Tenants Whww Pa Winter Park Fl

Florida Sales Tax Rates By City August 2022

The 10 Best Assisted Living Facilities In Summerfield Fl For 2022

Florida Sales Tax Information Sales Tax Rates And Deadlines

Florida Sales Tax Handbook 2022

2022 Florida Sales Tax Rates For Commercial Tenants Whww Pa Winter Park Fl

Sales Tax Rates In Major Cities Tax Data Tax Foundation

How To Calculate Fl Sales Tax On Rent

Florida Vehicle Sales Tax Fees Calculator

Florida Dept Of Revenue Property Tax Data Portal